What Type Of Service Does Intuit Online Provides

Intuit QuickBooks Payroll offers an affordable, easily navigated payroll software application that is designed for pocket-size business owners.

Even better, if yous're looking for affordable accounting software, you lot tin subscribe to both QuickBooks Online Accounting and QuickBooks Payroll at significant savings. But not to worry, QuickBooks Payroll tin can still be used as a stand-alone payroll application, even if you use some other accounting software application.

Who is Intuit QuickBooks Online Payroll for?

QuickBooks Payroll, like all Intuit applications, is designed with the small business possessor in mind.

The application is designed for up to 50 employees, but because of the potential fees involved, information technology's really best suited for businesses with xv or fewer employees. The application is scalable and offers three plans, so you can easily motion upwards to the next program if you're looking for boosted product functionality.

Keep in heed that while you lot don't need to exist using QuickBooks accounting applications in lodge to apply QuickBooks Online Payroll, it tin can be really handy if you do.

Intuit QuickBooks Online Payroll's features

One of the things that sets Intuit QuickBooks Online Payroll apart from a lot of its competitors is that all its plans include total-service payroll capability, which is rare. QuickBooks Online Payroll currently offers iii plans: Core, Premium, and Elite, with all three plans including the following features:

- Unlimited payroll runs

- Direct deposit

- Automated tax calculations and filing

- Employee portal

The awarding offers unlimited payroll runs, and so you won't be charged if y'all need to practice an additional run.

The application will automatically summate, process, and file payroll tax forms, including tax deposits, for all fifty states, where necessary. It can handle both garnishments and deductions and allows you to add numerous employee pay types and designate multiple pay rates also.

All Intuit QuickBooks Online Payroll plans include free directly deposit, and you can pay your contractors in the awarding also. Another option lets y'all define policies for and automatically track paid time off, vacation, and sick fourth dimension. A mobile app is too available for both iOS and Android devices that volition let yous to run payroll, view employee information, and pay taxes, but you'll take to sign into the regular application if you wish to make any employee or pay rate edits.

Auto Payroll

Intuit QuickBooks Online Payroll includes an Machine Payroll option in all plans, which lets you run payroll without any additional entries. QuickBooks Online Payroll does allow you to review payroll before processing, and you can make any necessary changes or add boosted compensation for commissions or bonuses.

The downside of Auto Payroll: It simply handles salaried employees, and all of them must use direct eolith. In addition, all of your employees will need to exist in the aforementioned state, and east-services must be enabled.

QuickBooks Workforce

QuickBooks Workforce is a new characteristic that replaces the Paycheck Records pick previously available in Intuit QuickBooks Online Payroll. QuickBooks Workforce gives your employees online access to of import information: pay stubs and W-2s, year-to-date earnings and deductions, current taxation data, and bachelor time off.

To get your employees on QuickBooks Workforce, simply enter their electric current email accost during the setup process, and they will receive an email invite that allows them to gear up their account. Conveniently, QuickBooks Workforce is attainable from any device, including mobile phones.

Benefits

The Benefits option in Intuit QuickBooks Online Payroll provides an piece of cake way to obtain quotes and sign up for medical, dental, and vision insurance. You can easily view all quotes without obligation and fill out an application in minutes. In one case the application is approved, your employees will be able to enroll themselves in whatever benefit program that y'all offer.

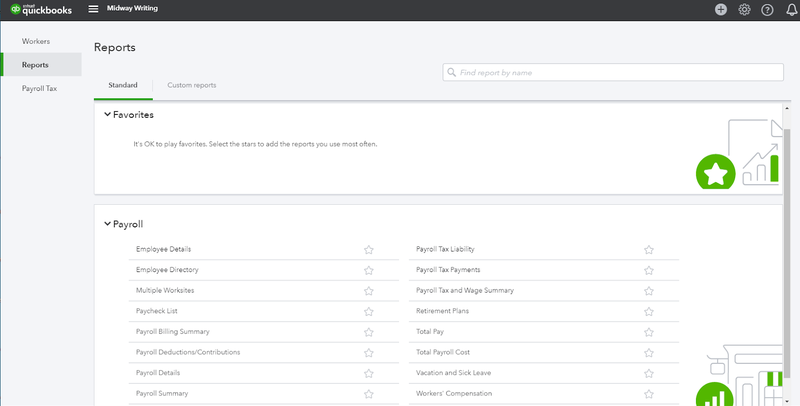

Reports

Intuit QuickBooks Payroll offers a rich selection of reports. One handy feature in Reports lets you click on the star adjacent to any report, which so places the report at the tiptop of the Reports screen for quicker access. You can also create and salvage custom reports for future access.

QuickBooks Payroll offers an excellent selection of payroll-related reports.

Source: QuickBooks Online Payroll software.

Intuit QuickBooks Online Payroll study customization is express, merely you tin export reports to Microsoft Excel for farther customization if needed.

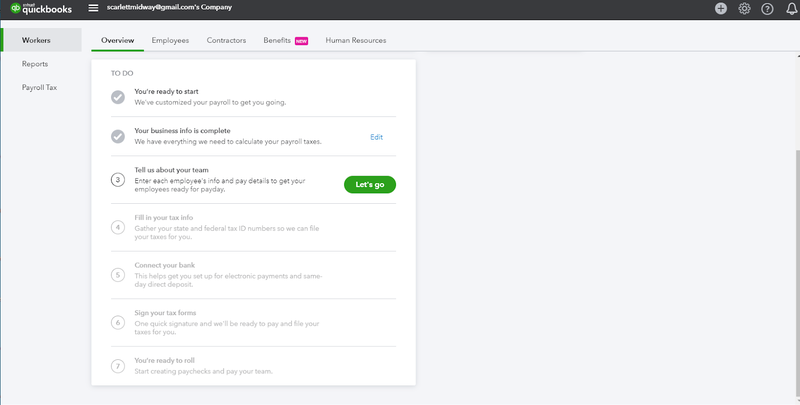

Intuit QuickBooks Online Payroll's ease of use

Intuit QuickBooks Payroll offers an easy onboarding procedure, the awarding guiding you pace-by-step through each process. You exercise need to be prepared to enter the information requested, then be sure you have admission to your federal and state revenue enhancement ID numbers and cyberbanking data, which you'll need in social club to complete the setup process.

Intuit QuickBooks Payroll offers an piece of cake onboarding process.

Source: QuickBooks Online Payroll software.

Navigating through the awarding is easy, even for new users. Intuit QuickBooks Online Payroll offers intuitive organization navigation, which includes an abbreviated carte bar, along with easy access to all included features from the main entry screen. Payroll tin be processed in three steps, and with Auto Payroll, you can run payroll without entering whatever pay information.

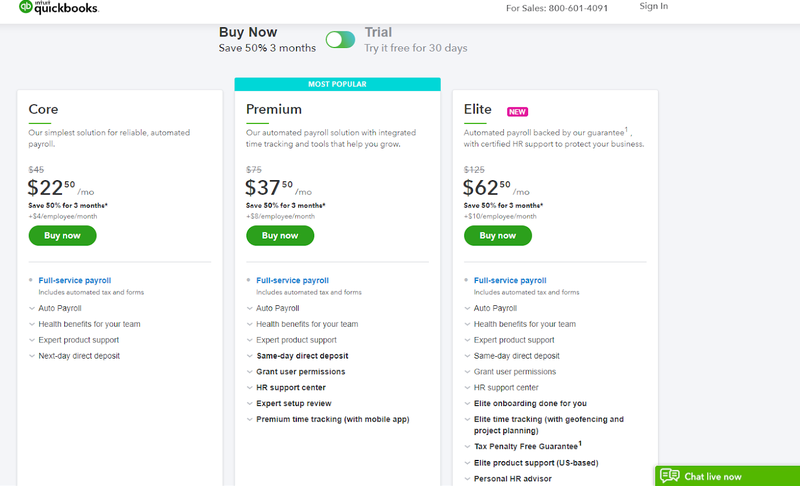

Intuit QuickBooks Online Payroll's pricing

Intuit QuickBooks Online Payroll offers 3 program levels, but what sets QuickBooks Online Payroll apart from other payroll providers is that even the lowest priced payroll program offers full-service payroll processing.

QuickBooks Online Payroll offers three plans and all include full-service payroll.

Source: QuickBooks Online Payroll software.

This is a major bonus for small businesses that don't wish to handle their own payroll tax processing, filing, and remittance, but don't have a large enough budget to purchase ane of the more expensive plans.

The Core programme is currently discounted 50% to $22.l per month for the start three months, then goes to $45.00 per calendar month, plus an additional $iv per employee. The Core program does pay taxes, but it only files for 1 state, so if you pay employees in more than one state, you'll pay an additional fee of $12.

The Premium plan is currently discounted fifty% to $37.50 per month for the first three months, so it goes to $75.00 per calendar month, with an $eight per employee additional fee. In addition to the Core plan features, the Premium program too offers aforementioned day direct deposit and the Hr Support Center. The Center provides easy access to state and federal wage and overtime laws, assists with custom job descriptions and employee onboarding, and offers employee functioning tools.

The Elite plan is currently discounted 50% to $62.50 per month for the first three months, which then jumps to $125 per calendar month, plus a $10 per employee additional fee. The Elite plan offers onboarding, access to a personal 60 minutes counselor, plus all of the features constitute in the Cadre and Premium plans. The Elite plan too lets you pay employees in an unlimited number of states at no actress charge.

Working with Intuit QuickBooks Online Payroll support

Telephone and messaging support is included with all QuickBooks Online Payroll subscriptions. All payroll back up is U.S. based, and available during regular business organisation hours. In addition, QuickBooks Online Payroll offers easy access to numerous indexed support manufactures, likewise as curt, pace-by-footstep preparation videos that guide you through diverse payroll tasks.

Benefits of Intuit QuickBooks Online Payroll

If you lot're a QuickBooks Online Accounting user, Intuit QuickBooks Online Payroll volition allow seamless integration of your payroll application with your accounting software. Plus, you can automatically post payroll entries to your full general ledger.

While the benefits may non exist so obvious if you're a pocket-size business owner non using QuickBooks Online Accounting, yous tin can still do good from using Intuit QuickBooks Online Payroll. You lot will have affordable admission to full-service payroll at whatever programme level, costless straight deposit, and a portal that lets employees track vacation and sick time in the application.

Is Intuit QuickBooks Online Payroll Right for you?

While Intuit QuickBooks Online Payroll is optimally designed for minor businesses that use QuickBooks Online Bookkeeping, the application tin can also detect a spot in businesses not currently using QuickBooks applications. If you have less than xv employees and are looking for total-service payroll, QuickBooks Online Payroll may be worth a second await.

The Motley Fool has a Disclosure Policy. The Writer and/or The Motley Fool may have an interest in companies mentioned.

What Type Of Service Does Intuit Online Provides,

Source: https://www.fool.com/the-blueprint/payroll/software/intuit-quickbooks-online-payroll-review/

Posted by: monroebestudy.blogspot.com

0 Response to "What Type Of Service Does Intuit Online Provides"

Post a Comment